Part 1

One of the great misunderstandings in NFT is that they must be bought or that it can only be “created” by artists. In fact, nothing can be further from the truth (and hopefully it will be). On the contrary, most NFTs should be earned and received for free, not bought. Current experiments centered around asset ownership is only a skeuomorphic extension of the traditional concept of ownership. What will bring NFTs to billions will be non-tradable user records that can represent individuals in the digital world. As crypto is going through another cycle, I hope this post will shed a light on what NFTs can do. Without further ado, let’s get started.

For the uninitiated, let’s take a quick re-cap on what NFTs are.

A non-fungible token (NFT) is a non-interchangeable unit of data stored on a blockchain, a form of digital ledger, that can be sold and traded.[1] Types of NFT data units may be associated with digital files such as photos, videos, and audio. Because each token is uniquely identifiable, NFTs differ from most cryptocurrencies, such as Bitcoin, which are fungible.

Non-fungible token on Wikipedia

We considered use cases of NFTs being owned and transacted by individuals as well as consignment to third party brokers/wallets/auctioneers (“operators”). NFTs can represent ownership over digital or physical assets. We considered a diverse universe of assets, and we know you will dream up many more:

– Physical property — houses, unique artwork

– Virtual collectables — unique pictures of kittens, collectable cards

– “Negative value” assets — loans, burdens and other responsibilities

In general, all houses are distinct and no two kittens are alike. NFTs are distinguishable and you must track the ownership of each one separately.

EIP-721 Non-Fungible Token Standard that defined technical standard for NFTs

Combining the two, in summary,

- NFT stores unique set of data that can represent other forms of digital data or real assets

- Each NFT is unique and distinct

- You can own it and credibly prove your ownership

That’s it! Deceptively simple and beguilingly broad. In short, NFTs can be anything because it can represent anything. Let’s not think about how it represents something else for now, we’ll have another chance to talk about it (There are lots of problems in how we make that bridge currently such as it being a mere json object in some company’s Google Cloud database, i.e. off-chain). For this post, let’s specifically focus on the potential that NFTs possess. As a start, let’s look into PFPs, specifically BAYCs, that are currently dominating the space.

Bored Ape Yacht Club (BAYC)

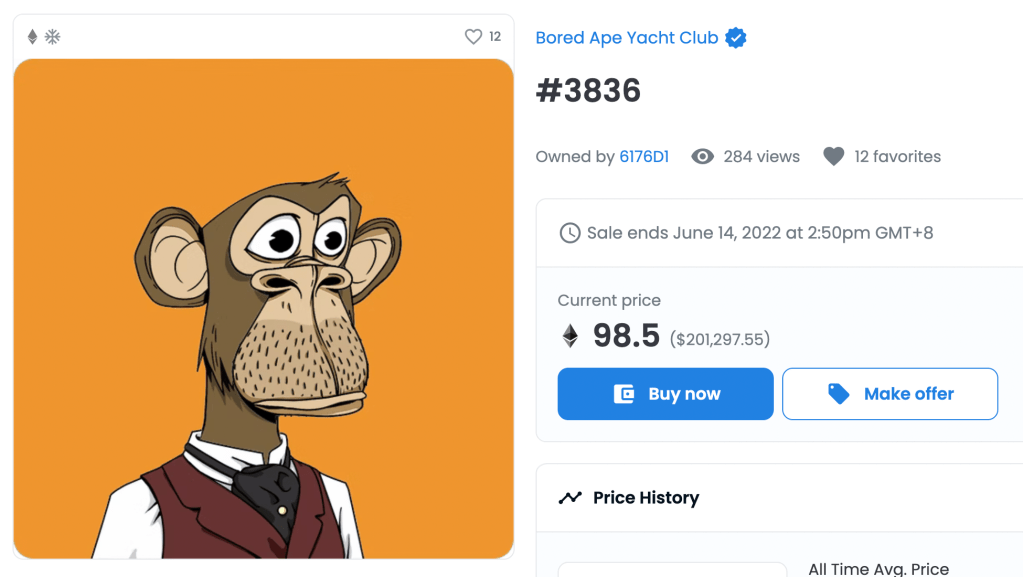

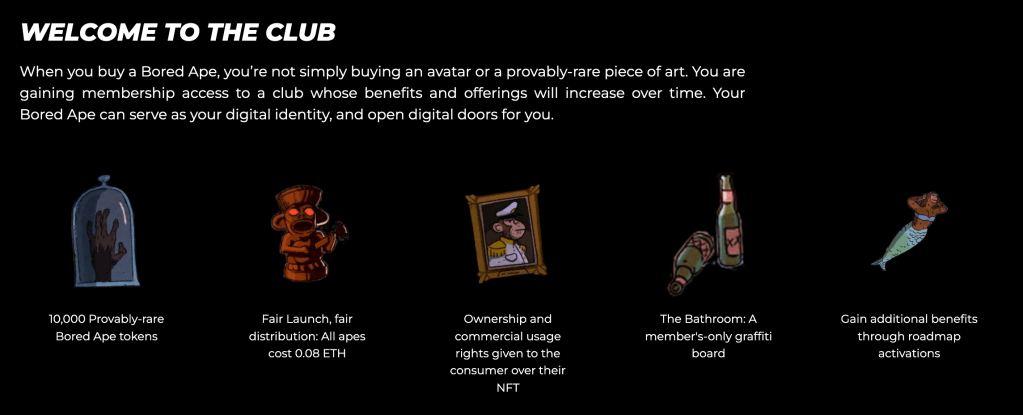

By now, you must have heard about BAYC and their 10,000 cartoon primates. They’ve skyrocketed into the public’s imagination as celebrities like Madonna, Eminem, and Justin Bieber have swept them up for mind-boggling prices. So what are they and what’s so special about them?

Probably the simplest parallel that you can draw is to own an artwork. Similar to any artwork, you can buy them for investment, expression of one’s taste, status symbol, and many more. BAYC is no different here. Each BAYC NFT represents a unique digital cartoon primate art and people can buy them for any number of reasons.

Its innovations come from somewhere else: 10,000 works with different traits that become an identity and a ticket to an exclusive social club. For one, different traits have made it easier for people to associate themselves to their BAYCs. But as you will see across Twitter, such PFP NFTs are extremely common nowadays. Literally almost everyone has one (including me).

The more important innovation is how the founders of BAYC have managed to build a real community out of it as the name “Club” indicates. It has managed to build the most cohesive and coveted digital-first community within a span of mere year. (The price of each BAYC climbed exponentially in the meantime)

Having started humbly with member’s only digital graffiti board and a Discord server, it has sprawled into a full-on metaverse with its own tokens and world. Throughout the growth, BAYC holders have been constantly rewarded with even more NFTs, tokens, and exclusive accesses. However the Club didn’t limit itself to the digital world.

They’ve already organized numerous IRL events like ApeFest where holders could meet and celebrate their apes in parties, cosplays, and live shows. In short it’s a global social club with celebrities as regular guests, criss-crossing virtual and offline worlds, and crypto’s most coveted money-making machine. That’s already freaking cool. Most of BAYC’s achievements would haven’t been possible if it were not on blockchain (global distribution, verifiable ownership, deep liquidity, etc).

Not only that, BAYC holders possess full commercial rights to their BAYC IP. It has spawned all kinds of commercial, creative derivatives ranging from beers, music band, merchandises, and movies. 6529, famous anonymous NFT collector, aptly summarized every BAYC as a decentralized franchisee. So it’s not just a social club, but an economic cooperative as well. Each BAYC is priced differently, but each BAYC’s value feeds into the entire system, creating a virtual cycle of value generation. How cool is that?

More excitingly, there will be many many more economic and social cooperatives that use NFTs as their medium (most recently Moonbirds). It’s definitely new. But it’s only for holders.

Part 2

Exclusivity falls short

It ultimately falls short because they are exclusive. By definition, exclusive clubs are meant to be kept small. Smaller the better in most cases. It won’t bring NFTs or Web 3 to billions. If you have two clubs where one has 1 million members and the other has 10,000, it’s not hard to see which one is more exclusive (not necessarily more valuable, but likely). Not only that but exclusive clubs have a heavy existential baggage that they must constantly address: appeasing holders. Regardless of how many derivatives that they make, it will always have to reward the club members more than the outsiders because frankly then what would be the point of a club. Right? So it will constantly create a dynamic of insiders v. outsiders, haves v. have nots, OGs v. noobs that be perennially at tug of war for power and influence. Now that BAYC has even given out governance tokens ($APE) that non BAYC or MAYC holders can buy freely in the market, it will be interesting to see how these forces come into play.

Of course, we’ll likely have many of these clubs across the world, across our digital lives. We may even see certain clubs at war with each other due to some whatever differences. Heck, now it’s not just your social status or identity that is attacked. Your very financial well-being is under attack as your membership is 24/7 tradable in the open market. Given such a high barrier to entry (both in terms of price tag and limited spots), it’s not easy to imagine that current forms of social clubs will bring NFT to the mass public. With daily fluctuating and exorbitant prices, it’s probably a surer way to isolate the vast majority of the public than not. As builders in the Web 3, we shouldn’t limit the public’s imagination from our failure of imagination.

Role of BAYC and most of the PFPs is that they can show what interesting and cool new things can be built on top of blockchain. But however cool and new it is, if we think about it, it’s still a skeuomorphic implementation of traditional ownership. That’s where we need to imagine more.

Skeuomorphism

Let’s go back to the idea that NFTs are equivalent to digital art. In itself, there’s nothing new. We have just made owning an art massively easier in every dimension including most notably provenance, transparency, and liquidity. But these innovations stem from blockchain itself, but not in the implementation of NFT itself. Of course, as we’ve seen, artwork-like NFTs have unlocked massive new space of community. However I would argue that even the community organization is more of an extension of what traditional art communities couldn’t have done. Just to be clear, I’m not saying that they are not innovative. I believe they are great, all I’m trying to say is that they are after all what’s been envisioned for centuries regarding collecting art. In other words, it’s art first, Web3 later. It’s not a Web3-native thinking.

Right, that’s where our imagination has faltered. We have focused too much on “asset” ownership, traditional method of its acquisition and dynamics of creator and buyers. If we want to scale NFT to billions, I think NFTs should be earned, acquired when you are born, and retrieved with actions. We need a shift from Buy to Earn / Get. As blockchain upends the concept of ownership, so should our thinking about what can be owned. We are not just going to own assets any more, we are going to own our digital crumbs, which will outnumber assets in a blink.

NFT in the Age of Abundance

NFTs’ ultimate innovation will come from owning not something rare, but something abundant and personal. Key secondary effect of the Internet as the transaction cost went to zero was that it also made the cost of digital ownership zero as well. Whether it’s your Kindle books or Spotify songs, you can now own an infinite amount of them. And our actions leading up to those purchases are also generated at zero cost and are quietly being accumulated at each company’s databases. We just don’t know whether we actually own those actions or purchases, let alone where they are stored. That’s all.

With blockchain, now we can imagine a world where we can digitally own anything and prove our ownership instantly. Although the cost to ownership hasn’t yet gone to zero in blockchain, I strongly believe that it’s only a matter of time. Just look at the exponential decrease in gas cost that L2 networks have brought on (and of course other alternative L1s as well). Even better, the cost will keep going down. And there will be some or a lot of networks that make that possible. While our imagination in application has often lagged, the direction of progress in technology has never swayed; everything will become better, faster, and cheaper.

More than anywhere else, our current and future field of abundance will be in the digital realm. And with that I think NFTs are also (already) ripe for disruption to being tokens of abundance rather than scarcities. Scarcity has its place, but it’s not for the masses. Abundance is. Facebook or Instagram or Twitter or Google brought the Internet to everyone not by making every action exclusive and interactive, but by making it free and easy. (We can argue what users have traded for and we can apply to see what that might be in the Web 3 in the later posts :D). So should the NFTs.

Question: So we can own anything digitally at zero cost. Now what should we own then?

Answer: ourselves!

Part 3

We already own tons of ourselves. Our searches, locations, downloads, tweets, likes, photos, clicks, purchases, actions, and etc. They are just locked up as rows and rows of data in companies’ databases. We need to transform them to NFTs.

Of course, I’m not proposing to say that our every digital action should be NFTs. They should be something discrete, memorable, and worth recording. Maybe something irreversible? What would satisfy these characteristics? Maybe your check-ins? Maybe your purchase records? There might not be so many categories, but I think the above two already suggest good starts.

Just Imagine. What if we can turn our purchase history into NFTs that can be shared selectively to e-commerces that we go to? What if we own the transaction records of all our clothing? Not Amazon or Zara or Lululemon? What if we can selectively turn on and off access to certain purchases? Each e-commerce will literally have to re-configure their experience to fit your purchase history when you, for instance, “Sign In With Ethereum” to shop. The world will literally change for you. How cool would that be?

Instead of BYOB, BYOD (“Bring Your Own Data”) may be a more popular term in the near future. And one day, BYOD wouldn’t be a thing anymore because it becomes the norm.

True Interoperability

Another big benefit of NFT that’s touted a lot is its interoperability. Yes, it’s true that BAYC can be exported to other applications built on top of Ethereum. In other words you can brandish your BAYC to any metaverse games you go and use it as your profile. But games would also want to support each NFT slightly differently, especially when it’s not part of their native ecosystem. For instance, why would I support one asset from one game to the fullest with all its superpowers in another one especially when it’s from a competing game? Not only that our games can be completely different too! In other words, NFTs will have limited support in non-native ecosystems. So it will never be truly interoperable.

There’s likely no (or at least less than what people expect) synergy between competing games, because they have to make more money for themselves (as profit-seeking ventures). If the original studio takes X% commission every time the NFT is traded, why would competing games want to encourage it to increase in value especially within its own games. So NFTs & their supported metaverses will need some kind of lock-in, some kind of differentiation, however weak. So no true interoperability will exist unless you are the derivative of a given project.

Question: So what can be truly interoperable or composable?

Answer: Again, ourselves!

When NFTs are about me, they become truly interoperable. Because who I am doesn’t change across different platforms. Yes, I may want to share only certain parts of me, but even those certain parts will still be me. We are not creations of some games, so we are not bound by the rules of them as well. The current “NFTs” that we have are ultimately about the ecosystem that each creator builds themselves and even with well-thought out, agreed protocols, there will be friction across platforms. In that sense, I am the only true interoperable component.Your records, transactions, experiences, and activities can be composable and interoperable to the fullest sense. And even better. They will create synergies as you stack more of them across different platforms. Different applications will change depending on your record. Going back, I cannot emphasize this enough. The world will change depending what data you bring, what access you give them. And it will change in real-time when you access them. In the end, we will have a customized OpenSea, Uniswap, Amazon, and Google for everyone.

Part 4

NFT’s Netscape Moment

Would there be any other way where NFT can reach billions? There should be a lot. Below are some of the key possible watershed moments.

- When people can see their assets across previously wall-gardened platforms (e.g. Google Searches showing up in Bing Searches, just as an example in Web 2)

- When people can have fun with it (StepN / Axie)

- When people can toggle on / off permission to access or read their data and when that toggle changes the experience of the app / website (a.k.a “When the whole world changes to fit your taste” )

However above moments all still require substantial financial investment to begin with in the current set-up. Well why? Because they have to be bought or minted.

In that regard, I think Buy to NFT will soon reach a ceiling and we will need a new model. To me, the most likely and exciting way seems to be when everyone has or earns NFTs by default. When we “breathe” NFTs, that’s when its true potential as a new and cheap mechanism of ownership will shine. Obviously there are many many questions. For instance, how should your transaction record be stored as an NFT? Should we just follow ERC-721? Can we use ERC-721 for every type of our data? Can we create a universal protocol for our own data NFTs? These are all great questions and I would love to tackle them in the future.

When NFTs become commoditized with our own data, I think that’s when Web 3.0 will really happen. I can’t wait to see it.

If anyone wants to chat, feel free to drop a comment or email me at sang.ha.park@outlook.com 😆

Leave a comment